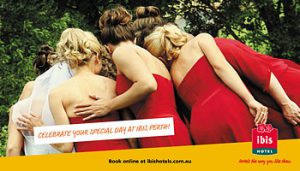

Ibis Hotel

This modern city-centre hotel is a 3-minute walk from Perth Underground train station and 11 minutes on foot from the ...

Accor Hotels

Spend your perfect memory for any season in Perth in one of our hotels. We are a French multinational hotel ...

Novotel Hotels

It goes without saying that your Wedding Day should be perfect … unforgettable. At the Novotel Perth Hotel Langley we ...

Mercure Perth

Plan the perfect wedding reception at Mercure Perth. Your wedding is one of the most important days in your life ...